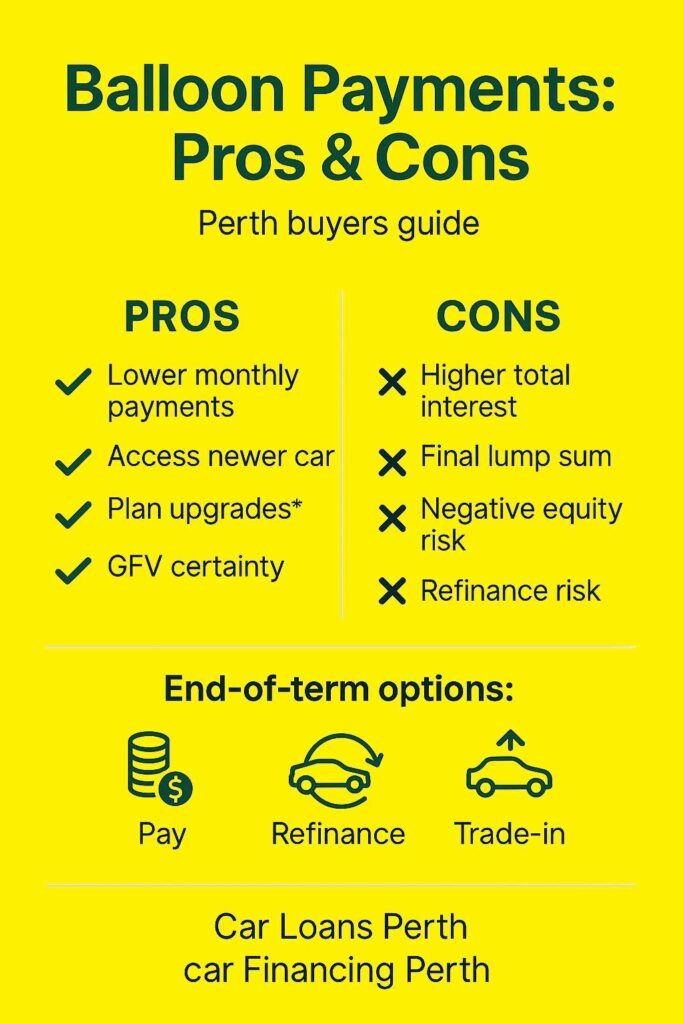

Balloon payments reduce monthly installments by pushing a large “residual” to the end of the term. The trade-off is higher total interest, a final lump sum due at maturity, & exposure to resale or refinancing risk. Understanding how balloons work—plus how they affect cash flow, equity, & upgrade timing—helps Perth buyers choose a car loan structure that fits budget & risk tolerance.

What a balloon payment is (and isn’t)

A balloon is an agreed residual—often 20–50% of the original amount—that remains unpaid until the end of the contract. Regular repayments are calculated on the financed balance minus the balloon, so monthly outgoings look lower than a like-for-like loan with no residual. The balloon is not a deposit; it’s a deferred principal you still owe. At term end, the amount must be paid in a lump sum, refinanced, or cleared by selling/trading the vehicle. Because a large portion of principal is outstanding for longer, total interest across the term is usually higher than on an equivalent loan with no balloon.

How balloons change cash flow, equity & flexibility

Lower monthly repayments improve short-term cash flow & can help align outgoings with seasonal income. However, slower principal reduction means less equity if the car is sold early or written off. If market values drop faster than expected—due to high kilometres, model-specific depreciation, or supply shifts—there’s a risk of negative equity at trade-in. Balloons concentrate risk at a single date: if refinancing conditions tighten, interest rates rise, or credit profile changes, rolling over the residual may be costlier or unavailable. For disciplined buyers who plan ownership cycles carefully, balloons can time payments to match upgrade points; for ad-hoc changes, they reduce flexibility.

Typical structures you’ll see in the market

Lenders offer balloons as a percentage of the original amount or as a fixed dollar residual. Terms commonly range from 36–60 months, with 30–40% balloons on new vehicles more prevalent than on older stock. Some manufacturer programs use “guaranteed future value” (GFV) variants: meet condition & kilometre limits, & you can hand the car back for the guaranteed amount, pay the residual to keep it, or trade into a new model. GFV reduces resale uncertainty but introduces condition caps, return fees, & strict servicing/tyre requirements. Business borrowers may see balloon/residual language in chattel mortgages or novated leases; tax & accounting treatment differs from consumer loans, so tailored advice is prudent.

Pros: when a balloon can make sense

Balloon structures can be appropriate in several scenarios:

- Cash flow matching. Lower regular repayments free budget for insurance, fuel, tyres, or other household costs.

- Planned upgrade cycles. If you intend to swap vehicles at 3–4 years, a balloon can align the residual with expected trade-in value, minimising mid-term prepayment friction.

- Short holding periods. When the vehicle is a stop-gap, prioritising cash flow over equity build can be sensible—provided the exit plan is clear.

- Access to a newer, safer vehicle. A balloon may enable a later-model car with better safety tech & warranty coverage versus stretching an older, higher-risk option.

- GFV certainty. Where offered, a guaranteed value can cap downside risk from depreciation—useful for models with volatile resale.

Cons: the risks & hidden costs to watch

Balloon arrangements introduce specific downsides:

- Higher total interest. Because principal stays higher for longer, lifetime interest generally increases even if the rate is the same.

- Refinance or payout risk. The final lump sum must be available, refinanced, or offset by trade-in; a change in rates, employment, or credit score can complicate this.

- Negative equity potential. Unexpected depreciation, excess kilometres, or damage can leave the car worth less than the residual.

- Tighter program rules. GFV deals often require strict servicing & condition standards; non-compliance can trigger fees or value reductions.

- Behavioural risk. Lower monthly outgoings can tempt upgrades beyond realistic budgets, leading to repeated rollovers & escalating total costs.

Worked example (simple, non-rate specific)

Consider a $45,000 purchase with a 30% balloon. The residual at term end would be $13,500. Monthly repayments during the term are lower because payments are calculated on the remaining $31,500 (before fees & deposit effects). However, total interest paid over the life of the loan would be higher than an equivalent structure without a residual, since $13,500 remains outstanding for the entire term. At maturity, options are: pay $13,500 in cash, refinance that amount (subject to approval & current rates), or trade/sell the car & use sale proceeds to clear the balloon.

Perth-specific considerations

Resale dynamics in WA can differ from east-coast markets due to regional demand for utes & SUVs, distances travelled, & mining-related cycles. Higher kilometres from long-distance use can erode resale more quickly than planned, increasing negative equity risk against the balloon. Insurance gaps matter: if the car is written off mid-term, standard comprehensive policies pay market value, which may not clear the residual; gap cover can protect against shortfalls between insurer payout & the loan balance. Budget for on-road costs, tyres suited to Perth conditions, & corrosion/paint protection where appropriate, as these factors influence both ownership cost & end-of-term value.

Due-diligence checklist before choosing a balloon

- Exit plan. Decide now: keep, trade, or refinance at maturity; set a savings or sinking fund if paying cash.

- Stress test. Could the household handle a 1–2% rate rise at refinance time or a 10–15% resale shortfall?

- Kilometres & condition. Estimate annual use realistically; confirm GFV limits & condition standards if applicable.

- Fees & flexibility. Check early payout fees, variation charges, & whether extra repayments reduce interest without penalties.

- Insurance & gap. Price comprehensive cover & consider gap cover to manage total-loss scenarios.

- Term fit. Avoid terms that exceed warranty coverage if repair risks would strain the budget.

- Comparison rate focus. Compare the comparison rate (not just headline rate) to capture fees & true cost.

- Independent valuation. Sense-check balloon % against conservative resale guides, not best-case dealer talk.

Alternatives to consider

- Larger deposit, no balloon. Higher monthly outgoings, lower total interest, stronger equity build.

- Shorter term, modest balloon. Balances cash flow with faster principal reduction.

- Savings plan for the “balloon”. Park the would-be residual in a high-interest savings account & take a standard loan; at month 36–48, use savings to clear the remaining balance—maintains control without contractual residual risk.

- Certified used with slower depreciation. A 2–3-year-old vehicle can reduce residual risk if resale curves are flatter.

- GFV only if limits suit use. Choose a mileage band that matches real driving; otherwise, a standard balloon may offer fewer condition traps.

Who balloons tend to suit (and who they don’t)

More suitable: Buyers with predictable upgrade cycles, stable employment, disciplined budgets, & realistic kilometre forecasts. The structure also fits households that value lower monthly outgoings but can accumulate cash toward the final lump sum.

Less suitable: Drivers clocking high annual kilometres, buyers planning to keep the car far beyond the term, or anyone whose income is variable without a safety buffer. If frequent job changes or credit uncertainty are likely, the refinance risk at maturity can outweigh the monthly savings.

Conclusion

Balloon payments lower monthly repayments but usually increase total interest and create a final lump-sum risk. Before signing, map an exit plan (pay, refinance, or trade), stress-test for rate rises & resale shortfalls, and confirm insurance & gap cover. Compare lender structures via Car Loans Perth options and dealership car Financing Perth programs, then choose the smallest residual that still fits budget. If those checks are marginal, prefer a standard loan to build equity sooner and avoid end-of-term pressure.

0 Comments