Refinancing a truck loan can be a smart move for business owners and drivers in Perth looking to reduce monthly repayments, improve cash flow, or access better loan terms. However, without a clear understanding of the refinancing process and potential pitfalls, it can lead to unnecessary costs or long-term financial strain.

Understanding Truck Loan Refinancing

Refinancing involves replacing your current loan with a new one—typically with improved terms, such as a lower interest rate or extended repayment period. It’s often used to adapt to changes in business conditions, upgrade to newer vehicles, or consolidate multiple truck loans into one manageable repayment.

Before refinancing, it’s essential to assess:

- The current loan balance and early exit fees.

- The interest rate and potential savings offered by the new lender.

- The total cost of the new loan, not just the monthly repayment.

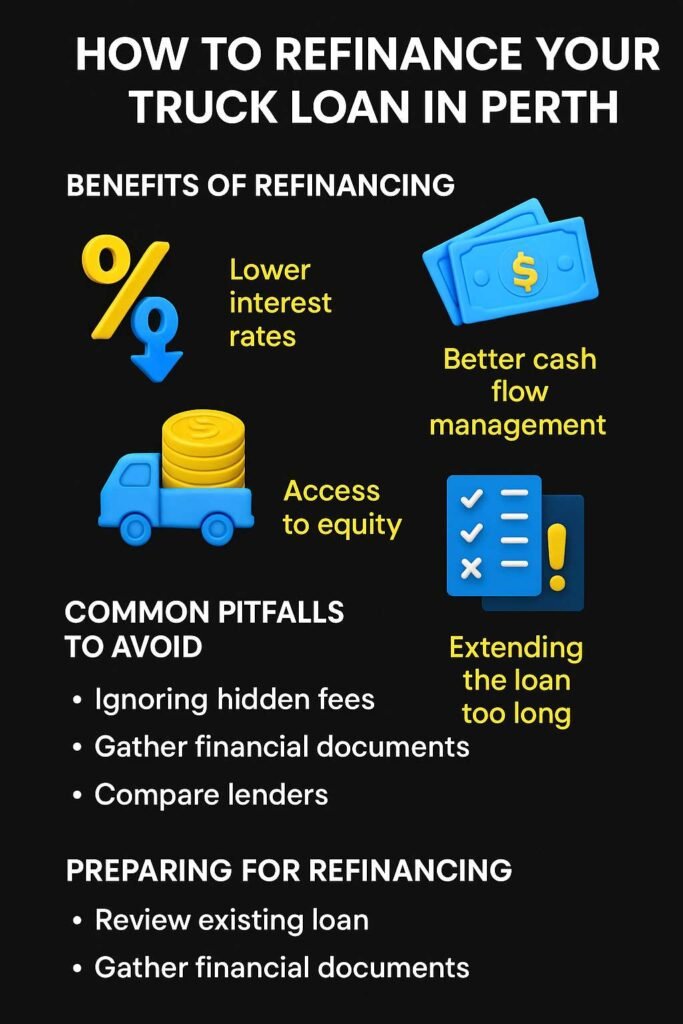

Benefits of Refinancing

1. Lower Interest Rates

If your business has improved its credit profile or market rates have dropped, refinancing may unlock lower interest rates. This can significantly reduce the total loan cost over time.

2. Better Cash Flow Management

Extending the loan term may reduce your monthly repayments, easing financial pressure and freeing up funds for other operational needs such as maintenance, fuel, or insurance.

3. Access to Equity

If your truck has retained value, refinancing can allow you to access some of the equity for business reinvestment or to finance new equipment.

Common Pitfalls to Avoid

1. Ignoring Hidden Fees

Many drivers overlook discharge fees, application costs, or valuation expenses when refinancing. These can offset the savings from a lower interest rate if not calculated carefully.

2. Extending the Loan Too Long

While longer repayment terms lower monthly instalments, they increase the overall interest paid. Always compare total loan costs, not just the monthly repayment figure.

3. Failing to Compare Lenders

Different lenders offer varying structures and flexibility. Partnering with a trusted expert in truck financing Perth helps ensure you’re comparing equivalent loan features and avoiding unfavourable clauses.

4. Overlooking Balloon Payments

Some refinancing options include large final payments, or “balloon” amounts, which can strain finances at the end of the term. Ensure your repayment plan aligns with your business income cycle.

Preparing for a Smooth Refinancing Process

- Review your existing loan contract in detail.

- Gather updated financial statements and vehicle valuations.

- Seek professional advice from a broker experienced in truck loans Perth to ensure compliance with local finance regulations and secure the best available terms.

- Calculate potential savings using a refinance calculator before committing.

Final Thoughts

Refinancing your truck loan can improve financial flexibility and business sustainability—when done strategically. Avoid rushing into agreements without understanding the fine print or future implications. By consulting with qualified truck finance specialists, Perth businesses can confidently make refinancing decisions that support long-term growth.

0 Comments