Purchasing a truck is more than just acquiring a vehicle—it’s an investment that influences operational capacity, maintenance budgets, and financial stability. In Perth’s competitive logistics and transport industry, choosing between a new or used truck requires careful consideration of both upfront costs and long-term financial impacts. Understanding how each option affects financing decisions can help businesses make strategic choices that support growth.

New Trucks: Benefits & Financial Considerations

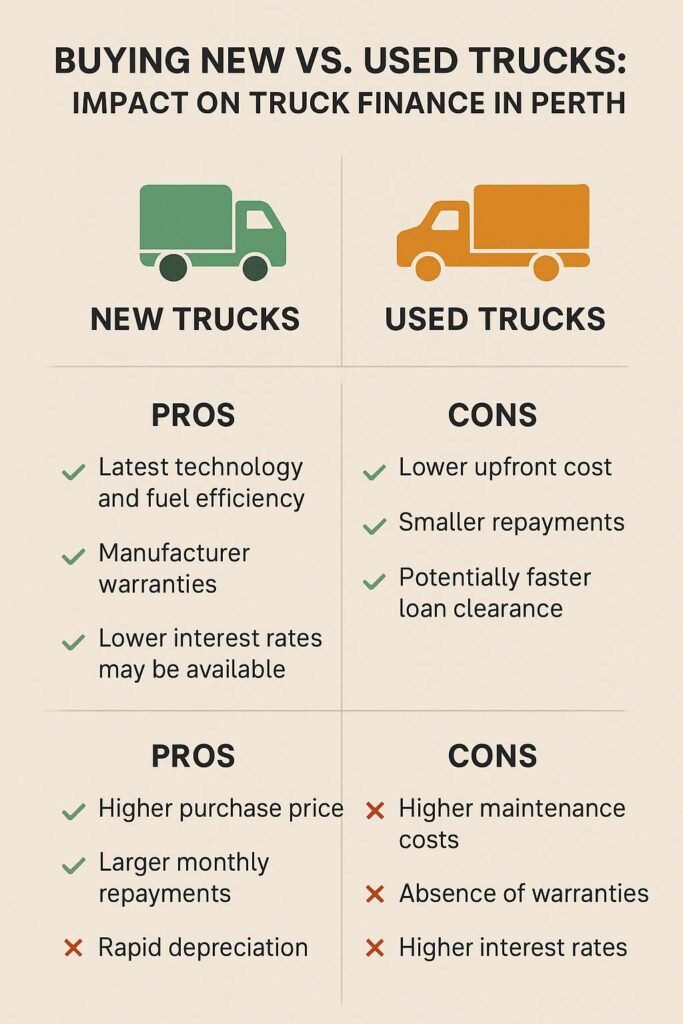

New trucks bring peace of mind through reliability, fuel efficiency, and compliance with the latest environmental standards.

- Financing Impact: Lenders generally prefer financing new trucks because of their lower risk profile. This often translates into more favourable loan conditions such as lower interest rates, higher loan-to-value ratios, and longer repayment terms.

- Operational Benefits: Modern safety features and advanced telematics systems can reduce insurance premiums and support compliance with industry regulations.

- Hidden Challenges: While attractive, new trucks depreciate rapidly, particularly in the first three years. Businesses must plan for this depreciation to avoid being underinsured or owing more on finance than the truck’s resale value.

Used Trucks: Benefits & Financial Considerations

Used trucks are a popular option for businesses looking to minimise upfront costs while expanding fleet capacity.

- Financing Impact: While the purchase price is lower, lenders may apply stricter terms, such as higher interest rates or shorter repayment periods, due to increased risk.

- Operational Benefits: Lower monthly repayments make it easier for smaller businesses or contractors to enter the market without heavy capital outlay.

- Risks to Manage: Ongoing maintenance costs can be unpredictable, and warranties may no longer apply. A thorough inspection and service history review are essential before committing.

Total Cost of Ownership (TCO) Analysis

When comparing new and used trucks, businesses should consider the total cost of ownership rather than just the purchase price:

- Maintenance & Repairs: New trucks typically require less servicing in the first years, whereas older trucks may demand frequent repairs.

- Insurance Costs: Insurance premiums are often higher for new vehicles but may balance out over time thanks to advanced safety features.

- Fuel Efficiency: Newer models usually have improved fuel economy, which can significantly reduce operational costs in long-haul businesses.

Impact on Truck Financing in Perth

The decision between new and used vehicles directly affects the structure and terms of truck loans. Businesses prioritising stability often opt for new trucks, while those seeking affordability and flexibility lean toward used options. Either way, customised financing solutions are vital. An experienced provider specialising in Truck Financing Perth can help structure agreements that align repayments with seasonal cash flow patterns, ensuring businesses can manage expenses during slower trading periods.

Tax & Depreciation Considerations

Australian businesses may also benefit from tax incentives such as instant asset write-offs, which can make new truck purchases more financially attractive. Used trucks may not deliver the same depreciation advantages, but their lower purchase price reduces the capital required, freeing resources for other investments.

Choosing the Right Financing Partner

The choice of finance provider is as important as the truck itself. A reputable Financing company Perth can offer tailored products such as leases, chattel mortgages, and hire purchase agreements. They can also advise on structuring repayments to minimise tax liabilities and improve cash flow. Beyond funding, trusted advisors provide insights into risk management, fleet planning, and compliance with lending requirements.

Conclusion

Whether to invest in a new or used truck is not a one-size-fits-all decision. New trucks provide reliability, better financing terms, and lower maintenance risks, but they demand higher capital commitment and face rapid depreciation. Used trucks offer affordability and smaller loan commitments but require careful maintenance planning. Partnering with an experienced financing company ensures that the choice—new or used—fits within a broader business strategy, helping Perth operators balance cost, risk, and long-term profitability.

0 Comments