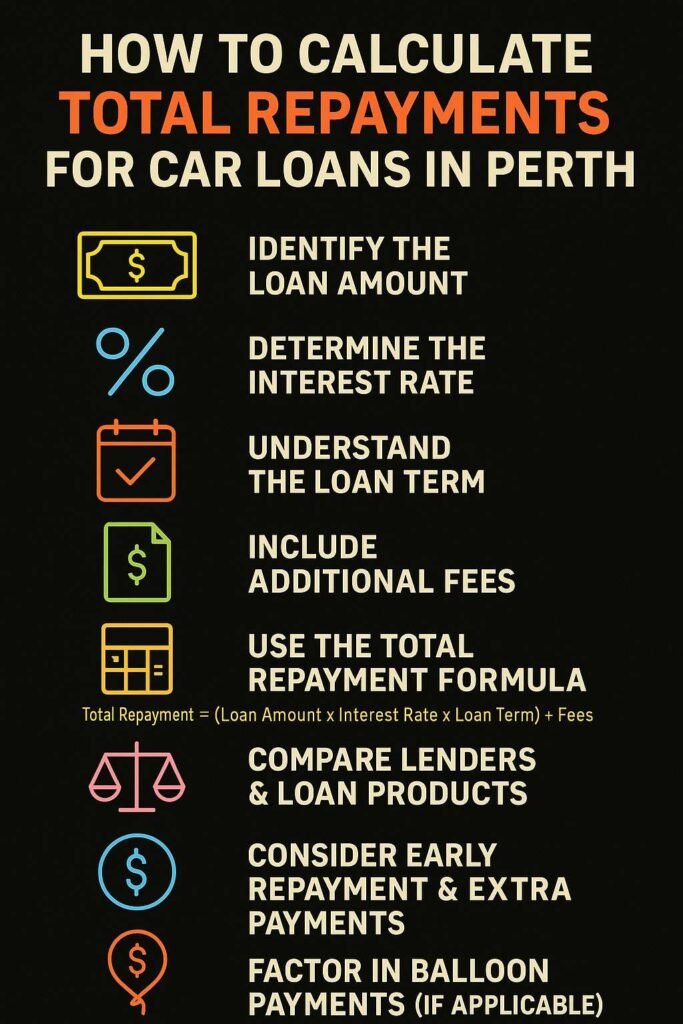

Calculating total repayments for a car loan Perth is crucial for effective budgeting and avoiding unexpected financial stress. Total repayment includes not just the amount borrowed but also interest and other fees across the life of the loan. Here’s an in-depth guide to help Perth borrowers understand each step when evaluating their car finance options.

1. Identify the Loan Amount

Start by determining the principal—the amount you intend to borrow. This figure is typically the vehicle’s purchase price minus any deposit or trade-in value.

- Tip: Always check if other costs such as dealer delivery fees, stamp duty, and registration are included in the loan amount.

- Why it matters: A higher principal directly increases total repayments, so negotiating the car price or making a larger deposit reduces both monthly installments and interest paid over time.

2. Determine the Interest Rate

Interest represents the cost of borrowing and is often the largest contributor to total repayments. Lenders may offer fixed or variable rates:

- Fixed rate loans: The interest remains constant throughout the term, providing predictable repayments.

- Variable rate loans: Payments may fluctuate as the lender adjusts rates due to market changes.

- Tip: Compare the comparison rate, which includes both the base interest and standard fees, for a clearer picture of the loan’s real cost.

3. Understand the Loan Term

The loan term refers to the length of time—usually between 24 to 84 months—over which you’ll repay the loan.

- Shorter terms: Higher monthly payments but lower overall interest paid.

- Longer terms: Lower monthly payments but higher total repayments due to extended interest accrual.

- Tip: Choose the shortest term you can comfortably afford to minimise the total cost.

4. Include Additional Fees

Car loans often come with extra costs, such as:

- Establishment or application fees

- Monthly account-keeping fees

- Early repayment or discharge fees

- Late payment charges

These fees, although sometimes small individually, can accumulate significantly over time. - Tip: Request a detailed fee schedule from the lender before signing the loan agreement to avoid surprises.

5. Use the Total Repayment Formula

For loans with simple interest, use:

Total Repayment = (Loan Amount × Interest Rate × Loan Term in Years) + Loan Amount + Fees

Example:

If you borrow $30,000 at a fixed annual interest rate of 5% over 5 years with $600 in total fees:

- Interest = $30,000 × 5% × 5 = $7,500

- Total Repayment = $30,000 + $7,500 + $600 = $38,100

For loans with compound interest or balloon payments, use a car loan calculator or request an amortisation schedule from your lender for accuracy.

6. Compare Lenders & Loan Products

Different lenders in Perth offer varied interest rates, repayment structures, and fees.

- Tip: Compare at least three lenders, considering not just advertised rates but also flexibility, customer support, and penalty terms.

- Value: A 1% difference in interest can save thousands over a typical 5-year loan.

7. Consider Early Repayment & Extra Payments

Many borrowers save money by paying off their loans early or making extra payments:

- Advantages: Reduces principal faster, decreasing total interest paid.

- Caution: Check for early repayment penalties that may offset these savings.

- Strategy: Even small additional monthly payments can make a significant difference over the loan term.

8. Factor in Balloon Payments (If Applicable)

Some car loans include a balloon payment—a lump sum due at the end of the term.

- Impact: While monthly repayments are lower, you’ll need to budget for the final large payment or refinance it.

- Tip: Always add the balloon payment to your total repayment calculation for a realistic financial picture.

Conclusion

Calculating total repayments in Perth before committing to a loan empowers you to make better financial choices. By understanding every component—loan amount, interest, term, fees, and extra features—you can identify the most affordable option and avoid hidden costs. For expert guidance and tailored loan solutions, consult a trusted Car loans company Perth to compare options and plan your repayments effectively. This approach ensures you stay in control of your finances while enjoying your new vehicle with confidence.

0 Comments