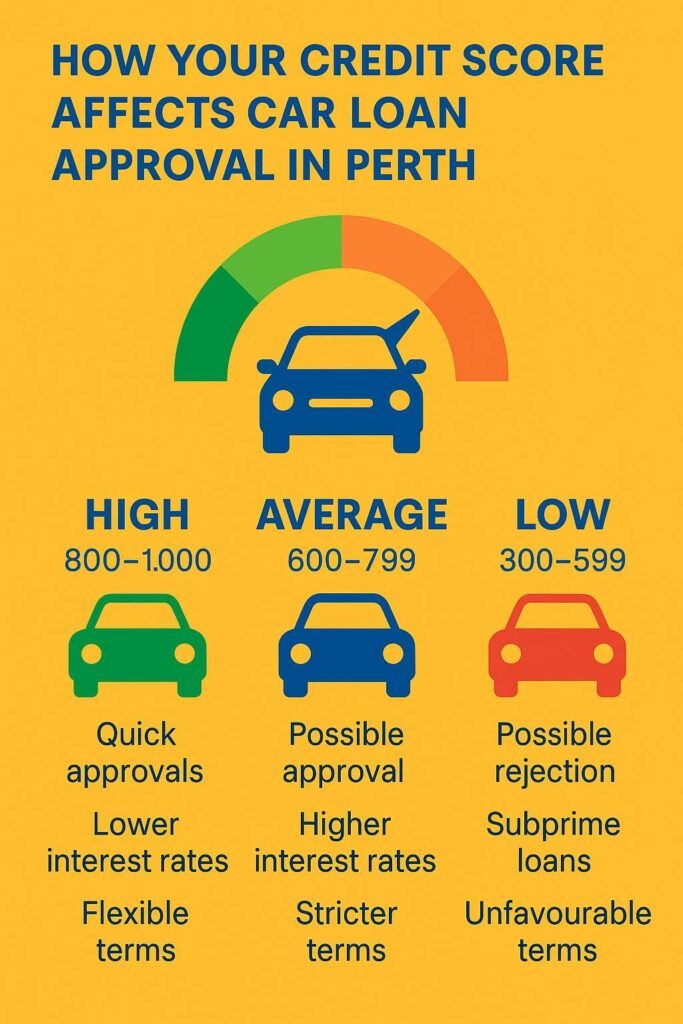

When applying for a car loan in Perth, your credit score is one of the most influential factors lenders use to assess your application. Understanding how credit scores affect approvals, interest rates, and loan terms can help you prepare better and increase your chances of securing a favourable deal.

Why Credit Scores Matter

Lenders rely on credit scores to evaluate risk. A high score signals that you have a history of managing debt responsibly, which reassures lenders that you are more likely to meet repayment obligations. Conversely, a low score may indicate missed payments or defaults, raising concerns about lending risk.

Impact on Loan Approval

- High Credit Scores: Applicants with strong scores are more likely to receive quick approvals, lower interest rates, and flexible repayment options.

- Average Credit Scores: Approval is possible, but terms may include higher interest rates or stricter repayment schedules.

- Low Credit Scores: Applications may be rejected, or only subprime loans may be offered, often with unfavourable terms.

In short, the better your credit score, the more leverage you have in negotiating terms.

Interest Rates & Loan Costs

Your credit score directly impacts the cost of borrowing. A higher score can secure significantly lower interest rates, saving you thousands over the loan term. In contrast, a poor score often results in higher rates, increasing the total cost of ownership.

Improving Approval Chances

- Review your credit report for errors and correct them before applying.

- Pay down outstanding debts to reduce your credit utilisation ratio.

- Avoid multiple credit applications in a short period, as these can negatively affect your score.

Taking steps to improve your financial profile can make a measurable difference when dealing with lenders.

Choosing the Right Lender

Different lenders apply varying approval criteria. Working with a reputable car loan company Perth ensures you receive tailored advice and access to lending options that align with your financial situation. Many providers also offer guidance on improving eligibility before submitting an application.

Conclusion

Your credit score is central to car loan approval in Perth, influencing both your eligibility and the cost of finance. By maintaining a healthy credit profile and seeking expert assistance from trusted providers, you can improve your chances of securing competitive car loans Perth that suit your budget and lifestyle.

0 Comments