Unlock Your Business Potential

Flexible Equipment Financing Solutions

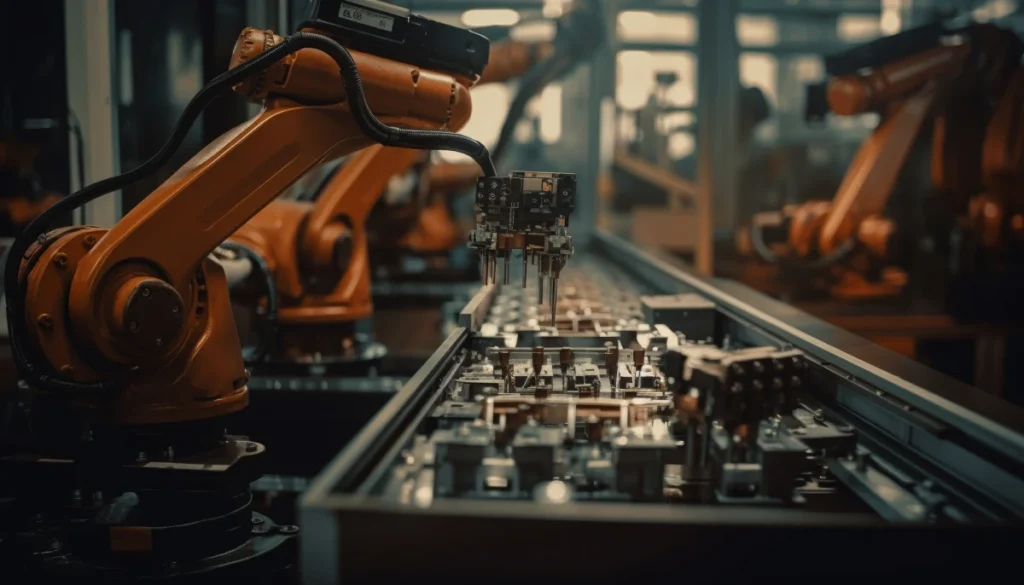

Empower your business with tailored equipment loans designed to meet your operational needs. From forklifts to heavy machinery, we offer competitive rates and fast approvals to keep your business moving forward.

The Truck Loan Application Process

Forklift Financing

Machinery Loans

Flexible Payment Plans

Unlock Your Business Potential

How to Apply for Equipment Loans

Submit Your Application

Fill out our online form with your personal and business details to get started.

Receive Approval

Our team reviews your application and provides a fast approval decision.

Access Your Funds

Once approved, quickly access your funds to purchase the equipment you need.

Unlock Business Potential with Equipment Loans

Securing an equipment loan can significantly boost your business’s operational efficiency. By providing the necessary capital to acquire essential machinery and tools, you can enhance productivity, reduce downtime, and stay competitive in your industry. Our flexible financing options ensure that you can invest in the latest technology without straining your cash flow, allowing for smoother operations and greater profitability.

Common Questions About Equipment Loans

You can finance a wide range of equipment including forklifts, machinery, trucks, and more. Our loans are designed to cover various business needs.

Our approval process is fast and efficient, typically taking just a few business days to complete.

Our minimum loan amount is $5,000, ensuring we can accommodate businesses of all sizes.

Applying is simple. Fill out our online form with your details and equipment requirements, and our team will guide you through the next steps.

Yes, we offer financing for both new and used equipment, giving you flexibility in your purchasing decisions.

Yes, we offer seasonal promotions and tailored financing solutions to meet specific business requirements. Reach out to learn more.

Equipment loans provide the capital needed to purchase essential tools, improving efficiency and allowing your business to grow without depleting cash reserves.

Interest rates vary based on the loan amount and term. Contact us for a personalized quote tailored to your business needs.

You’ll need to provide identification, business financials, and details of the equipment you wish to finance. Our team will assist you with the specifics.

Unlock Your Business Potential with Equipment Financing

Empower your business with the right tools. Secure an equipment loan today and take advantage of our streamlined application process. Whether you need forklifts, machinery, or other essential equipment, our flexible financing options are designed to meet your business needs. Don’t wait—apply now and propel your business forward with Frontline Car Loans!